Medicare Advantage Explained

Medicare Advantage Plans are another Medicare health plan choice you may have as part of Medicare. They look similar to the insurance you had through an employer and are usually offered as HMOs or PPOs.

Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” offer comprehensive coverage and are provided by private companies approved by Medicare, like Essence, Devoted, Aetna, UnitedHealthcare, Humana, Anthem, BCBS, Cigna, etc.

If you join a Medicare Advantage Plan, the plan will provide all of your Part A (hospital insurance) and Part B (medical insurance) coverage. Medicare Advantage Plans may offer extra coverage, such as vision, hearing, dental, and/or health and wellness programs. Most include Medicare prescription drug coverage (Part D).

Different Medicare Advantage Rules

When you enroll in a Medicare Advantage Plan, the company becomes your primary insurance. This policy provides an alternative way to receive Medicare benefits through managed care. Private insurance companies must follow rules set by Medicare since they are paid a fixed amount every month to “manage” your Medicare benefits for you. Because these private insurance companies receive funding by our Government, many of them do not charge you any additional premium, besides the current Medicare Part B premium. Some companies charge an additional premium above the Part B amount.

Because these plans DO NOT supplement Medicare, you will have different out-of-pocket expenses. That is the trade-off for not paying an additional premium for supplemental coverage. You typically have to pay the 20% coinsurance for Part B services like MRIs, Outpatient Surgery, Chemotherapy, and other expenses up to a certain amount each year.

Each Medicare Advantage Plan has different rules for how you get services (like whether you need a referral to see a specialist or if you have to go to only doctors, facilities, or suppliers that belong to the plan for non‑emergency or non-urgent care).

Medicare Advantage Breakdown

- You can only join a plan at certain times during the year. In most cases, you’re enrolled in a plan for a year.

- As with Original Medicare, you still have Medicare rights and protections, including the right to appeal.

- Check with the plan before you get a service to find out whether they will cover the service and what your costs may be.

- You must follow plan rules, like getting a referral to see a specialist or getting prior approval for certain procedures to avoid higher costs. Check with the plan.

- You can join a Medicare Advantage Plan even if you have a pre-existing condition, except for End-Stage Renal Disease.

- If you go to a doctor, facility, or supplier that doesn’t belong to the plan, your services may not be covered, or your costs could be higher, depending on the type of Medicare Advantage Plan.

- If the plan decides to stop participating in Medicare, you‘ll have to join another Medicare health plan or return to Original Medicare.

How Do You Pick the Best Medicare Advantage Plan?

A Medicare Advantage Plan may make sense for you if you think that a Medicare supplement and stand-alone Prescription Drug Plan may be too expensive for your budget.

Consider these things:

- Each plan has a different list of doctors that participate in the plan.

- Each plan has different hospitals that are in the plan.

- Each plan has different prescription drugs that they cover.

What we at Steinlage Insurance Agency will do for you is take your specific information (your doctors, preferred hospitals, and prescriptions) and find the plans that “fit” your needs the best. We find this is the best way to choose a Medicare Advantage Plan and eliminate surprises. For example, if you prefer the Barnes Jewish Hospitals, only certain Medicare Advantage Plans have contracts with that hospital. At Steinlage, our services are free and we are completely compensated by the insurance program you choose.

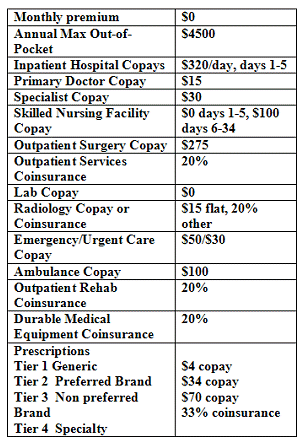

Below is a basic outline of how a Medicare Advantage Plan would offer benefits; this is an example, not an exact quote.

Get a Free Medicare Assessment Today

Please contact us regarding Medicare Advantage, Medicare Supplement, or Medicare Part D. This is a solicitation of insurance for your free, no-obligation evaluation of your situation. Give us a call, 636-561-5060 or fill in the form below to begin the process.