Medicare Advantage Plans for Charlottesville Seniors

Charlottesville seniors can choose Medicare Advantage Plans as part of their Medicare coverage. These plans are similar to the insurance you received from an employer and typically are available as PPOs or HMOs. At Steinlage Insurance Agency, we advise and help select the best Medicare Advantage Plans for Charlottesville seniors’ needs.

Receive a free Medicare assessment today.

Medicare Advantage Explained

Sometimes called “Part C” or “MA Plans,” Medicare Advantage Plans offer comprehensive coverage. Private Medicare-approved companies such as Anthem, UnitedHealthcare, Aetna, Humana, and Cigna provide these plans.

Your Medicare Advantage Plan will provide all your coverage of Part A (hospital insurance) and Part B (medical insurance). They also may offer additional coverage like vision, hearing, dental, and/or health and wellness gym programs. Most Advantage Plans include prescription drug coverage (Part D).

Medicare Advantage Rules

When you enroll in an Advantage Plan, the company becomes your primary insurance. As a result, your policy offers an alternative way to receive Medicare benefits through managed care.

Private insurance companies must follow stringent rules set by Medicare because they receive fixed monthly payments from the government to “manage” your benefits. Therefore, many of these companies don’t charge you an additional premium besides the current Medicare Part B premium.

Medicare Advantage Plans do not supplement Medicare, so you’ll have different out-of-pocket expenses as a trade-off for not paying additional premiums. You’ll typically pay the 20% coinsurance for Part B services like Outpatient Surgery, MRIs, Chemotherapy, and other expenses up to a certain amount annually.

Every Medicare Advantage Plan for Charlottesville seniors has various rules for how you receive services. For instance, you may need a referral to see a specialist or have to only visit doctors, facilities, or suppliers belonging to the plan for non-urgent care.

A Breakdown of Medicare Advantage Plans for Charlottesville Seniors

Since several intricacies and nuances are associated with Medicare Advantage Plans, we’ve outlined the most important aspects below.

- You can only enroll in a Medicare Advantage Plan during certain times of the year. You’ll be enrolled in a plan for a year in most situations.

- You have rights and protections as with Original Medicare, including the right to appeal.

- Check with your plan before receiving care to determine whether they’ll cover the service and if you’ll have out-of-pocket costs.

- You must follow plan-specific rules to reduce expenses, like getting approval for certain procedures or a referral to a specialist. Check with your plan.

- You can join a Medicare Advantage Plan even if you have a pre-existing condition.

- If you visit a doctor, facility, or supplier not affiliated with your plan, depending on the type, your services might not be covered or you may have higher costs.

- If the plan stops participating in Medicare, you must join another health plan or return to Original Medicare.

How to Pick the Best Plan

You may be a prime candidate for a Medicare Advantage Plan if you believe a supplement and standalone Prescription Drug Plan is too expensive. Consider the following when choosing the best plan for your needs:

- Every plan has different participating physicians.

- Every plan has different participating hospitals.

- Every plan covers different prescription drugs.

At Steinlage Insurance Agency in Charlottesville, VA, we’ll gather your specific information – your doctors, preferred hospitals, and prescription medications – and identify available plans that “fit” you best. We’ve determined that doing so is the best way to choose a Medicare Advantage Plan and eliminate surprises. For instance, say you prefer Martha Jefferson Sentara or UVA Hospital. Only certain plans may have contracts with that hospital.

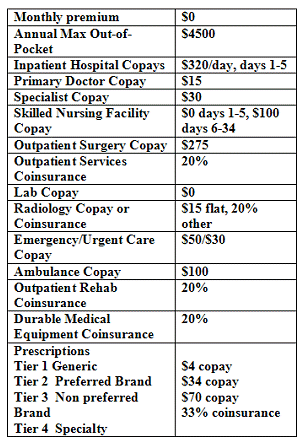

You can rest assured that at Steinlage, our services are free; we receive compensation directly from the insurance company you choose. Below is a standard outline of a Medicare Advantage Plan for Charlottesville seniors. It highlights how the plan offers benefits but it’s important to note that it is only an example, not an exact quote.

Receive a Free Medicare Assessment in Charlottesville, VA

Contact us today for a free, no-obligation Medicare assessment. Our Medicare consultants in Virginia will guide you through Advantage Plans, Medicare Supplement, and Medicare Part D. Give us a call at 571-777-1201 or complete the form below to get started. We look forward to providing an expert Medicare overview and finding a plan that suits you.