Medicare Advantage Plans in Richmond, VA

Medicare Advantage Plans are an alternative health plan choice within the Medicare system. Often dubbed “Part C” or “MA Plans,” these insurance options closely mirror employer-sponsored plans, typically offered as HMOs or PPOs. With Steinlage Insurance Agency, you can receive personalized guidance on Medicare Advantage Plans in Richmond, VA.

Get your free evaluation today.

About Medicare Advantage

Operated by private companies approved by Medicare—such as Essence, Aetna, UnitedHealthcare, Humana, Anthem, BCBS, Cigna, and more—Medicare Advantage Plans cover both Part A (hospital insurance) and Part B (medical insurance). These plans may include extras such as vision, hearing, dental, and health programs, often integrating Medicare prescription drug coverage (Part D).

Different Medicare Advantage Rules

Joining a Medicare Advantage Plan makes it your primary insurance and offers an alternative approach to managed care benefits. Individuals receive a unique perspective on healthcare coverage within the managed care framework. Compensated by the government, private insurance companies often avoid charging additional premiums beyond the standard Medicare Part B premium.

These plans don’t supplement Medicare but involve varied out-of-pocket expenses, a trade-off for no additional premiums. Out-of-pocket costs may involve a 20% coinsurance for Part B services like MRIs, Outpatient Surgery, and Chemotherapy.

Each Medicare Advantage Plan in Richmond, VA, has distinct rules for service accessibility. This includes requirements for specialist referrals and specific healthcare providers for non-emergency care.

Medicare Advantage Breakdown

A comprehensive understanding of Medicare Advantage Plans is essential for individuals seeking reliable and adaptable healthcare coverage.

Enrollment Considerations

Consider specific enrollment periods when joining a Medicare Advantage Plan in Richmond, VA. Enrollment is restricted to certain times annually.

Typically, individuals remain enrolled in a plan for a year, aligning with the annual enrollment periods. The structured timeline ensures a systematic approach to plan selection and enrollment.

Rights and Protections

Like Original Medicare, individuals opting for Medicare Advantage Plans in Richmond retain essential Medicare rights and protections, such as the right to appeal decisions. It ensures beneficiaries have recourse in disputes or disagreements with the plan’s coverage or decisions.

Navigating Plan Intricacies

Effectively navigating Medicare Advantage Plans includes contacting the chosen plan before seeking specific services. This proactive step helps you understand service coverage, clarifies costs, and reduces billing surprises.

Adherence to Plan Rules

Beneficiaries must adhere to plan rules, including obtaining referrals for specialists and securing prior approval for specific medical procedures. Compliance with guidelines is crucial to avoid higher costs. At Steinlage Insurance Agency, we encourage individuals to check with the plan for rule adherence.

Inclusivity of Medicare Advantage Plans

Medicare Advantage Plans inclusively welcome individuals with pre-existing conditions, except for End-Stage Renal Disease. The broader acceptance ensures that individuals with various health histories can access the benefits of these plans.

Considerations for Out-of-Network Services

Obtaining services outside the plan’s network may lead to uncovered services or higher costs. The extent of coverage and potential cost implications depend on the specific type of Medicare Advantage Plan selected. Our experts can help you determine the best option for your needs.

Plan Changes and Decision-Making

If a plan opts out of Medicare, beneficiaries must choose another Medicare plan or return to Original Medicare. Understanding the dynamic nature of Medicare Advantage Plans emphasizes staying informed about plan changes. Informed decision-making regarding healthcare coverage is crucial for those seeking reliable and adaptable insurance options, and our team is here to help.

How Do You Pick the Best Medicare Advantage Plan?

Choosing the best Medicare Advantage Plan in Richmond, VA, boils down to understanding your healthcare needs and budget. Start by evaluating your medical requirements and align them with a plan covering those services. Consider the monthly premium and potential out-of-pocket costs like deductibles, co-pays, and co-insurance.

Next, consider the network of doctors and hospitals the plan covers. If you have preferred healthcare providers or facilities, ensure they are within the plan’s network. Frequent travelers or those living in various locations should choose a plan with a broad network or out-of-network services.

Finally, check the plan’s quality ratings. Medicare rates each plan based on customer service, healthcare outcomes, and member satisfaction. These ratings provide an overall sense of its quality and reliability.

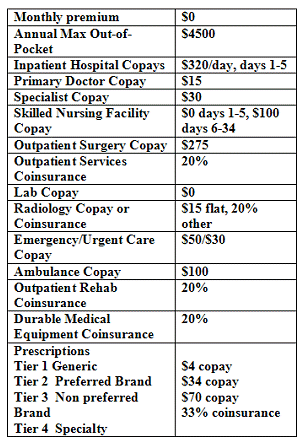

Medicare Advantage Chart

While the specifics may vary, a Medicare Advantage Plan typically offers benefits as outlined in the chart below.

How Steinlage Insurance Agency Can Help

At Steinlage Insurance Agency, we recognize the intricacies of Medicare Advantage Plans in Richmond, VA. Our thorough consultations empower you with the knowledge required to make informed decisions. To boost your confidence, we comprehensively understand coverage levels aligning with various medical and financial needs.

Beyond the basics, we extend our expertise to help you comprehend each plan’s network of doctors and hospitals. Our team assists in finding a plan that includes your preferred healthcare providers and facilities in its network. We can help you choose a plan with a broad network or out-of-network services for frequent travelers or those with multiple residences.

Steinlage Insurance Agency prioritizes transparency and quality. We provide clear quality ratings for each plan, including customer service, healthcare outcomes, and member satisfaction. We commit to ensuring your access to the highest quality healthcare.

Explore Medicare Advantage Plans in Richmond, VA, with a Free Assessment from Steinlage Insurance Agency

Steinlage Insurance Agency is your dedicated partner in navigating the complexities of Medicare Advantage Plans in Richmond, VA. We focus on transparency and informed decision-making as you take the next step to secure your future.

Contact us today for a free Medicare overview and assessment, and embark on a journey toward comprehensive and well-informed coverage. Your peace of mind is our priority.