Roadmap to Signing Up for Medicare

If you are one of the millions of Americans who find themselves out of work and out of health insurance in the near future, the following steps will take you through the Medicare Part B process. By following these steps you will successfully enroll into Part B at the appropriate time, without any late enrollment penalties, and be eligible for Medicare Supplement coverage without any concerns due to pre-existing conditions!

If you already have Medicare Part A, proceed to Step 1. If you do not have Medicare Part A, you are encouraged to enroll into Part A only through your ssa.gov account first and then proceed to Step 1.

Step 1: Determining the Correct Effective Date

Confirm when your group coverage actually ends and when COBRA (with its higher premiums) kicks in. The common end dates for someone retiring on a hypothetical date of June 10th would be:

- Coverage ends midnight on June 10th – Part B should begin 6/1

- Since you worked one or more days in a month, your coverage runs through the end of the month and ends 6/30 – Part B should begin 7/1

- Your employer offers a voluntary buyout program that you accept (or some variation of that) which offers an extra 60 days of paid coverage from the end of the month or you have 60 days of paid time off that includes employer-sponsored health insurance so you find benefits end 8/31 – Part B should begin 9/1

Once you know the specific date your coverage ends, your timeframe to start the Part B enrollment is 90 days prior from that date. In example 3, you can begin enrollment into Medicare + ancillary coverage (like a Medicare Supplement or Medicare Advantage plan) as early as June 1 for a September 1st effective date.

Step 2: Getting the Correct Forms Filled Out

Now that you have your timeline, you will need to get the following forms filled out.

The first one your HR department needs to sign off on and give back to you. The second one needs to be filled out by you and held until you get the other one back. You should make copies of the completed forms for your records just in case they get lost.

1. CMS L564 request for employer verification

You email, fax, or mail this form to your HR department and they return it to you. Your name/SS goes under the employee and the applicant (or if you are covered by a spouse, then his/her info goes on the employee line and the person signing up for Part B goes as the applicant).

2. CMS 40B application for Part B

Medicare number is the number on the Part A only card (if you recently signed up for Part A only, you can get the number from your myssa.gov account…if that isn’t feasible, I’d recommend using your social security number). You will need to write in the remarks box (section 12) “Please make Medicare Part B effective __/__/__” and fill in the correct date. So on example 3 from above, you would write 9/1/20XX.

If you have a spouse that is over 65 and also losing coverage at the same time, you will need 2 forms for each person (so a total of 4 forms) prepared in the same fashion.

Step 3: Delivering Prepared Forms

Once you have your forms filled out, you then need to get them to the Social Security office. SS has advised that these 2 forms can be mailed to a local office using the office locator here.

You can also fax these documents directly to SS at 1-833-914-2016. We recommend both faxing and mailing the completed documents to Social Security.

After you’ve mailed these forms, you can check on the status of your Part B enrollment by:

- Calling SS at 1-800-772-1213

- Or logging into your SS account here

Step 4: Paying for Part B

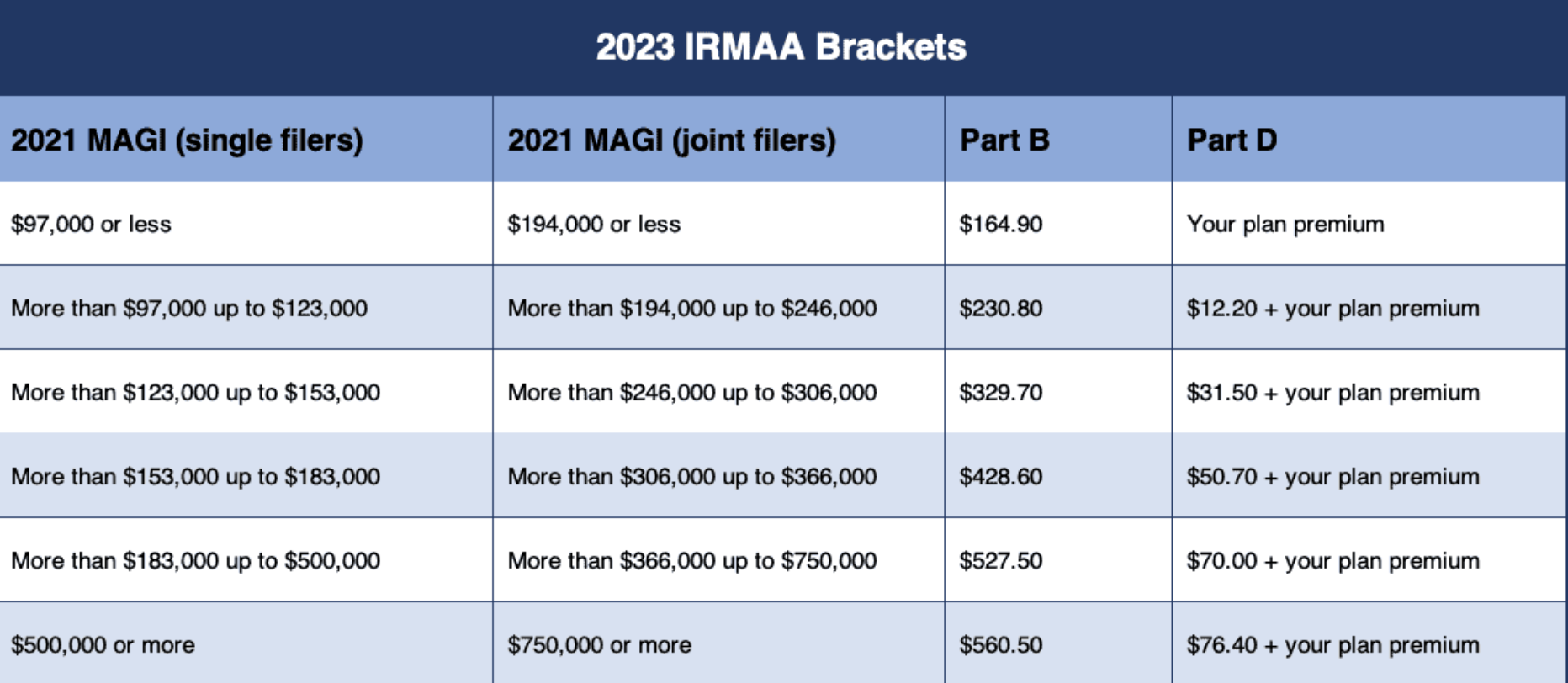

Now that you’ve successfully enrolled into Part B, you will be charged a monthly premium determined by the government. For 2023, the standard Part B premium is $164.90/mo per person. However, if your income has been above a certain amount, you may be hit with additional fees. If your income is over $97,000 for single or $194,000 married filing jointly, read on to learn about your least favorite acronym:

IRMAA (Income Related Medicare Adjusted Amount) special rules for higher-income beneficiaries

Medicare premiums are income adjusted and use a 2-year look back (so your 2021 Modified Adjusted Gross Income determines your total premium for Part B/D for 2023.

If you have had a qualifying event (like retirement) you can appeal the decision here. When appealing the income adjustment, you are asking the government to use a future year (like 2022 or 2023) rather than 2021.

Watch this video to learn more about appealing IRMAA:

Step 5: Pick Out Ancillary Coverage

Medicare by itself is a great base but really isn’t enough to do the job properly. That’s why people purchase Medicare Supplement + Medicare Part D for prescription coverage or choose to enroll into an all-in-one Medicare Advantage program.

This video explains the differences between the various options:

(The Part B premium for 2022 is $170.10/mo as discussed above)

Want free, personalized assistance through this process? Contact Steinlage Insurance Agency today and we’ll happily walk you through the process!